1. The peak period of automobile scrapping has arrived, and the policy is rationalized to reshape the development of the industry

(1) The demand for dismantling scrapped vehicles is strong, and the peak period for scrapping has arrived

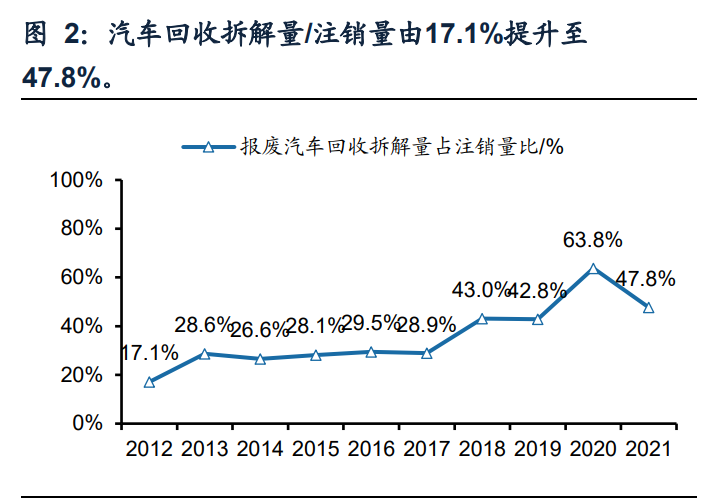

The automobile recycling and dismantling industry is booming, and the compound growth rate of the dismantling volume has reached 10% in the past five years. According to statistics from the Ministry of Public Security, in 2021, nearly 2.5 million scrapped vehicles will be recycled and dismantled in my country, a year-on-year increase of 20.7%. The compound growth rate in the past five years is 9.4%, maintaining a high growth trend. In the past ten years, the ratio of automobile recycling and dismantling to write-offs has also increased from 17.1% to 47.8%, reflecting the continuous improvement of industry standardization. Affected by the epidemic in 2020, the overall cancellation of automobiles will decrease, and the recycling and dismantling rate is as high as 63.8%. We believe that as scrapped vehicles gradually enter a period of high volume, the automobile recycling and dismantling industry will also enter a period of rapid development.

The domestic car ownership exceeds 300 million, and the demand for scrapped car dismantling is strong. By the end of 2021, the national car ownership will reach 302 million, a year-on-year increase of 7.5%. At present, the amount of scrapped and dismantled automobiles in my country is less than 1% of the total, which is far lower than the average level of 7% in developed countries. From 2007 to 2015, my country was in a period of rapid growth in automobile consumption. The compound growth rate of automobile ownership was 14.8%, of which the year-on-year growth rate in 2010 was as high as 19.2%. The peak period may have come.

my country's small passenger cars account for more than 65%. If 13 years are used as the scrapping cycle, it is expected that the scrapping cycle corresponding to the high growth of passenger cars from 2007 to 2015 is coming soon. Different models have different scrapping standards. We take the scrapping cycle of commercial vehicles as the basis. If we assume that the service life of general small, small and compact passenger cars is 13 years, the service life of medium, medium and large passenger cars is 15 years, and the service life of pure electric passenger cars is 15 years. The car is 8 years old. The scrapped cars in 2020-2025 correspond to the peak sales period in 2007-2012.

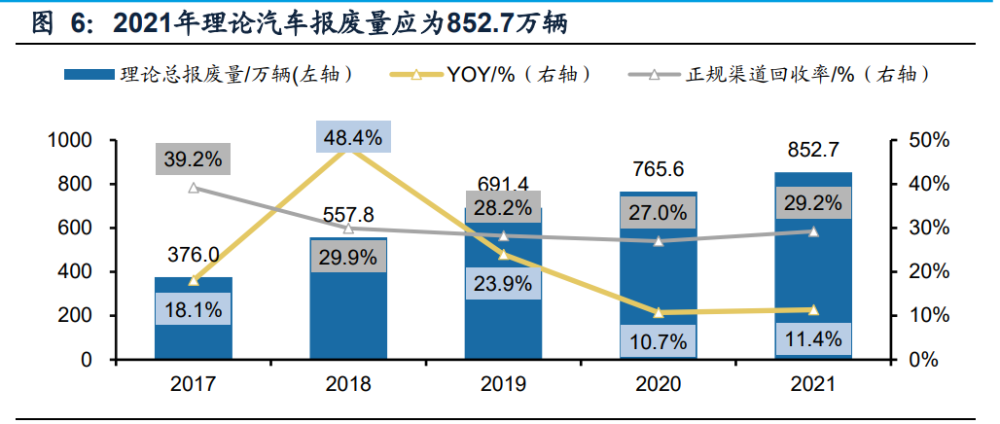

Based on the above-mentioned scrapping cycle, the current recycling rate of regular scrapped cars is less than 30%. According to the sales volume of various types of vehicles and their corresponding scrapping years, the theoretical scrapping volume of automobiles in 2021 should be 8.527 million vehicles, while the actual number of regular vehicles recycled and dismantled is only 2.493 million vehicles, and the recovery rate is as low as 29.2%. The current estimated recovery rate changes based on the scrapping period. Therefore, in the calculation, we increase the scrapping period of each model by 1, 2, 3, 4, and 5 years on the original basis. The calculation shows that even if the automobile scrapping period is extended by 4 years, the regular The car recycling rate is also only 66%. Therefore, with the growth of the dismantling volume and the continuous improvement of the regular dismantling rate, the prosperity of the automobile dismantling industry will continue to rise.

The low recovery rate may be due to the low price of cars collected through formal channels, which discourages some car owners from recycling. Before the promulgation of the "Administrative Measures for the Recycling of Scrap Motor Vehicles" in 2019, according to the "Administrative Measures for the Recycling of Scrap Vehicles" issued in 2001, the car owner's collection price when handing over a scrapped car to an enterprise with recycling and dismantling qualifications refers to the same ton weight. Scrap metal price accounting. According to China Business News, a Santana 3000 sedan with a weight of about 1.3 tons goes through formal scrapping channels, and the car owner usually only receives 1-2,000 yuan as a fare, but if it is sold through illegal channels, the price can reach 20,000-30,000 yuan Yuan, which is more than 10 times that of formal channels. In addition, the formal channels for scrapping cars are more complicated, and many scrapped cars have violation records. According to regulations, car owners need to make up for the unpaid fines before they can be scrapped, which further discourages some car owners from recycling. Driven by interests, car owners tend to trade scrapped cars on the black market for higher profits, which has led to a serious loss of scrapped cars.

(2) Loose policies and standardized management to ensure the healthy development of the automobile recycling and dismantling industry

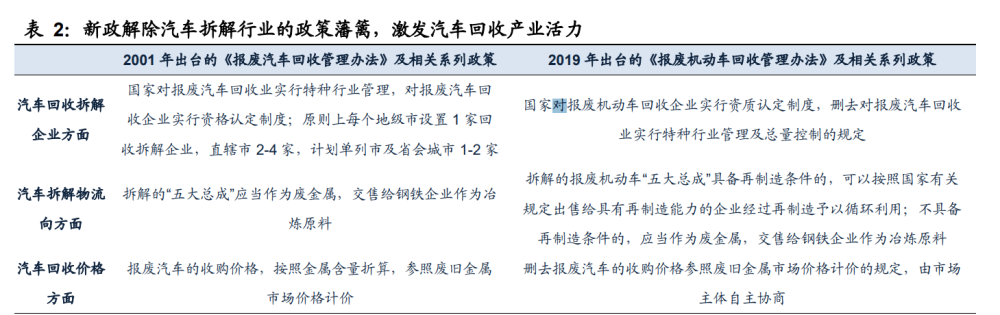

The policy of automobile recycling and dismantling is gradually loosened, and the core focus is on the remanufacturing of the "five major assemblies" and the traceability management of the whole life cycle. Since the initial clarification of automobile recycling procedures in 1980, China's automobile recycling and dismantling policies have gradually loosened: the scrapped automobile recycling and dismantling business has changed from a government monopoly to a market-oriented development; the management focus has changed from combating scrapped assembled vehicles to encouraging scrapped automobile parts resources. The release of the remanufacturing of the five major assemblies (engine, steering wheel, transmission, front and rear axles, and frame) and the lifting of the limit on the number of qualification certifications will also remove policy obstacles for the development of the automobile dismantling industry. We expect that with the development of new energy vehicles in the future Gradually entering the dismantling stage, relevant policies will also be introduced quickly. We have sorted out the policy interpretation of the automobile dismantling industry mainly through the following four stages, and we believe that the policy side of the automobile dismantling industry has been gradually straightened out:

1. Policy monopoly stage from 1980 to 1995: Preliminary standardization of automobile renewal and recycling procedures and scrapping standards for old automobiles, etc., forming a basic automobile recycling management system, and stipulating that only the material department can purchase scrapped automobiles.

2. The policy loosening stage from 1996 to 2007: the automobile dismantling business is no longer monopolized by the material department, but a qualification certification system for scrapped automobile recycling and dismantling enterprises is implemented; Remanufacturing is strictly prohibited, and can only be forced to be sold to smelters as scrap metal for refurbishment. At this stage, although the policy is mainly oriented to directly attack assembled vehicles, due to the "one size fits all" policy, the profits of regular car recycling and dismantling enterprises are low, which leads to low car prices. As a result, a large number of scrapped cars are traded on the black market, and assembled cars are repeatedly banned.

3. The policy liberalization stage from 2008 to 2018: the introduction of the "Regulations on the Mandatory Scrap Standard for Motor Vehicles" and the "Notice on Comprehensively Promoting the Elimination of Yellow Label Vehicles" has driven a substantial increase in the demand for scrapped car dismantling, and at the same time encouraged qualified dismantled parts Enter the market circulation, establish an effective incentive mechanism to encourage cars to "trade in", and start the pilot work of remanufacturing auto parts, allowing remanufacturers that have passed the third-party remanufacturing quality management system certification to recycle and dismantle qualified scrap cars. The "five major assemblies" were acquired and rebuilt to initially open the circular economy model.

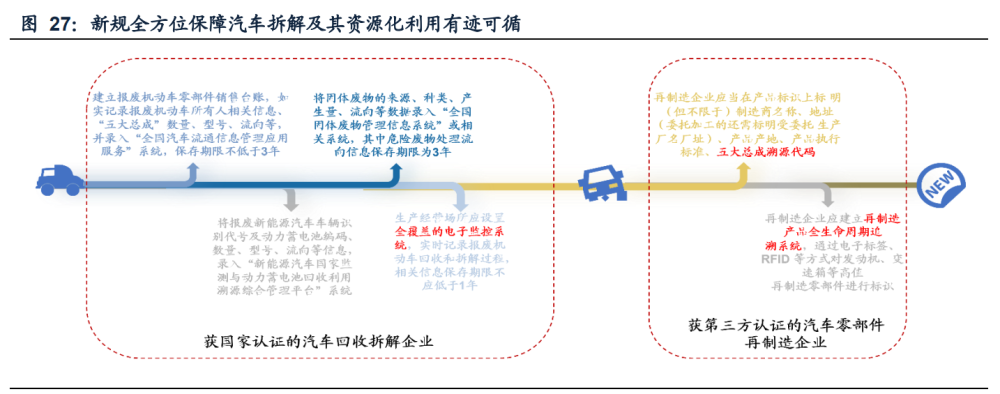

4. The policy improvement stage from 2019 to the present: the implementation of the "National VI" emission standard policy has been introduced to stimulate the demand for scrapped car dismantling. Two new regulations, the "Administrative Measures for the Recycling of Scrap Motor Vehicles" issued in 2019 and the "Interim Measures for the Administration of Auto Parts Remanufacturing" issued in 2021, have lifted the policy barriers of the automobile dismantling industry in many aspects. Lift the restriction that the car collection price is priced with reference to the market price of scrap metal, and mobilize the enthusiasm of car owners to scrap cars; Remanufacturing capabilities of enterprises, thereby improving the profit margins of recycling enterprises. According to the new regulations, the whole process of car dismantling is video-recorded and information is archived. At the same time, companies with remanufacturing capabilities need to establish a full life cycle traceability system for remanufactured products to comprehensively ensure that car dismantling and its resource utilization are traceable. The enthusiasm of front-end car owners for scrapping has increased, the profit margins of mid-end recycling companies have increased, the back-end remanufacturing industry has entered a new stage of standardized and large-scale development, and the automobile dismantling and remanufacturing industry is booming.

2. The dismantling profit increased, the dismantling rate increased, and the industry continued to develop in a healthy way

The automobile recycling and dismantling enterprises are represented by the recycling units established by the resource reuse enterprises, and the advantages of multiple integration and utilization of resources are prominent. The industrial chain of scrapped car dismantling and treatment includes upstream recycling, midstream pretreatment-dismantling-shredding, downstream resource utilization and other fields, corresponding to equipment manufacturers, recycling companies, dismantling companies, crushing companies, resource-based companies and remanufacturing companies. At present, automobile dismantling enterprises include three categories: automobile manufacturers, resource enterprises and other independent recycling enterprises, among which independent recycling enterprises are the mainstream. As the industry is generally faced with a small amount of front-end recycling and a low utilization rate of terminal resources, many leading resource reuse companies extend the car dismantling chain vertically, reduce material loss through upstream and downstream synergies, and carry out in-depth processing of recycled materials. , Significantly improve the level of resource utilization and increase its profitability.

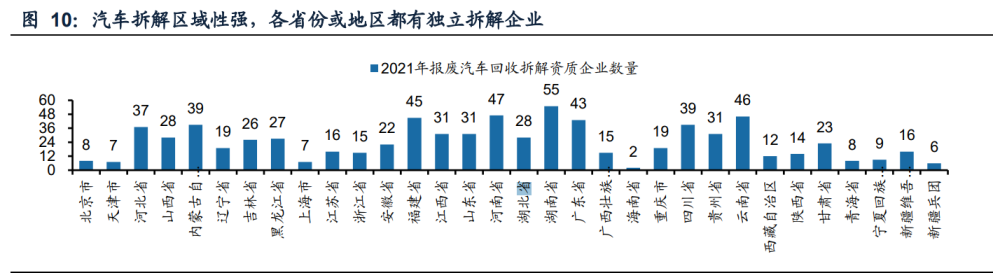

(1) Large-scale: The current concentration of regular car dismantling enterprises is low, and the policy level promotes large-scale

At present, the concentration of the automobile dismantling market is still low, showing a strong regionality. Vehicle recycling and dismantling licenses are issued independently by provinces, autonomous regions, and municipalities directly under the Central Government. Almost every province or region has an independent dismantling agency, which is regionally significant. As of February 2021, the distribution of scrapped motor vehicle recycling and dismantling enterprises across the country is relatively balanced, with more than 100 scrapped motor vehicle recycling and dismantling enterprises in East China, South China, Southwest China and Northeast China.

However, in recent years, the number of certified recycling companies has continued to grow, and the industry has entered a stage of large-scale development. Before the promulgation of the "Administrative Measures for the Recycling of Scrap Motor Vehicles" in 2019, the state controlled the number of recycling enterprises. In principle, each prefecture-level city set up one recycling and dismantling enterprise, 1-2 in separate cities and provincial capital cities, and 2 in municipalities directly under the Central Government. -4 homes. After the promulgation of the new regulations, the total control of certified enterprises will be cancelled, and the state will accelerate the expansion of the number of certified recycling companies. After the epidemic is lifted in 2021, the number of recycling companies will increase more rapidly. According to the Ministry of Commerce, as of 2021Q3, there were 916 end-of-life motor vehicle recycling companies nationwide, an increase of 18.2% from the end of 2020. With the rapid growth of the number of certified recycling enterprises, the industry has entered a stage of large-scale development.

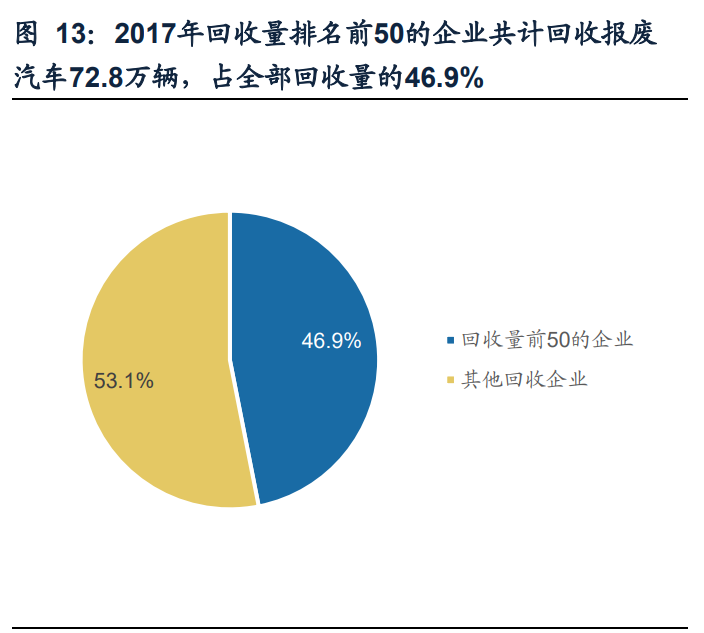

At present, the scale of dismantling enterprises is still generally small, the market competition is sufficient, and the number of participants continues to increase, and the industry is expected to accelerate the reshuffle. Although my country's scrap car recycling and dismantling industry has formed a certain scale, but limited by capital, technology, equipment, venues and other conditions, the recycling scale of most enterprises in the industry is relatively low, and the entire industry presents a "small and scattered" market structure. By the end of 2017, the number of qualified enterprises for recycling and dismantling end-of-life vehicles in my country had approached 700, of which only 5 enterprises had a recycling volume of more than 30,000 vehicles, and more than 30% of the enterprises had a recycling volume of less than 500 vehicles. There are 728,000 scrapped cars, accounting for 46.9% of the total recycling volume. The industry as a whole lacks economies of scale and competition is fierce. Under the guidance of easing policies, as of the end of 2019, there were 23,000 employees in scrap car dismantling across the country, and the total industry assets increased significantly to 26.79 billion yuan, a year-on-year increase of 20.1%; as of 2021Q3, the number of scrap car recycling and dismantling qualified enterprises has surged To 916, with the gradual release of licenses, the rapid growth of enterprises, we believe that the industry is expected to accelerate the reshuffle.

From the perspective of policy, positive changes have been ushered in. The new regulations set the minimum dismantling capacity to promote the large-scale development of the industry. Although the average dismantling volume of a single enterprise has gradually increased to 2,666 vehicles in recent years, it is still far below the minimum annual dismantling of 5,000 vehicles required by a single recycling and dismantling enterprise in the "Technical Specifications for Scrap Motor Vehicle Recycling and Dismantling Enterprises" issued in 2019. With the strict implementation of technical specifications, small car dismantling enterprises will be eliminated at an accelerated pace, and the industry is expected to develop large-scale and large-scale development.

(2) Enhancement of dismantling value: the release of five major assemblies + power battery recycling to improve corporate profitability

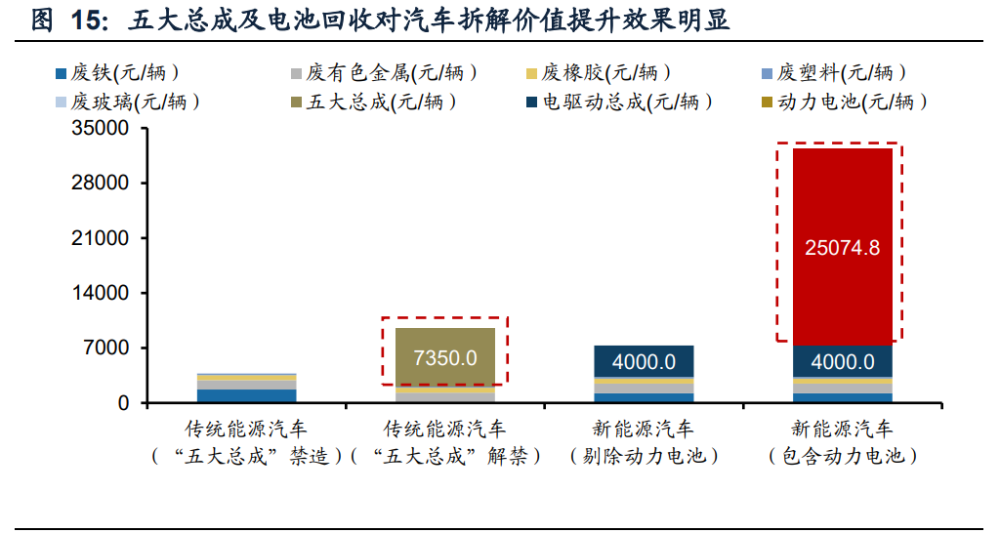

From the conclusion, the remanufacturing of the five major assemblies and the recycling of power batteries are very profitable, corresponding to an increase of over 1.5 and 7.5 times the value of the dismantling of traditional energy vehicles before the lifting of the ban on the five major assemblies respectively. billion. According to our calculations, the dismantling value of traditional energy vehicles is about 3,754.6 yuan. After the opening of the five major assemblies, the value will increase to 9,487.8 yuan, an increase of 150%. Although new energy vehicles do not consider the five major assemblies, their "three power" systems (battery, motor, and electronic control) are valuable for dismantling the core components of the vehicle. If battery recycling is considered, calculated based on the average metal price in 2021, The corresponding battery value is about 25,000 yuan. In the future, the amount of new energy vehicle dismantling will be released, and the market space of the automobile dismantling industry will continue to grow. In 2025, the overall market space of automobile dismantling will reach 127.13 billion yuan.

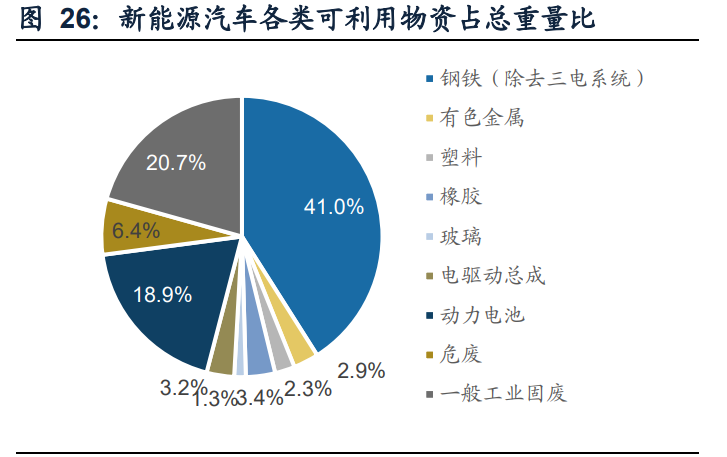

The dismantling chain of scrapped cars is complicated, and the "five major assemblies" account for over 70% of the value of traditional car dismantling. Automobile scrap recycling needs to go through three major processes: pretreatment, dismantling, and vehicle crushing. After the scrapped car is dismantled, the recyclable items will be refurbished and continue to circulate in the market, the parts that meet the remanufacturing conditions will be remanufactured and sold, and other unusable parts will be crushed and separated to produce scrap steel, Recyclables such as waste glass, waste plastic, waste rubber, etc. According to statistics, the dismantling of new energy vehicles accounts for more than 70% of the available materials, and the dismantling of traditional energy vehicles accounts for nearly 85% of the available materials, of which more than 2/3 are metal fragments.

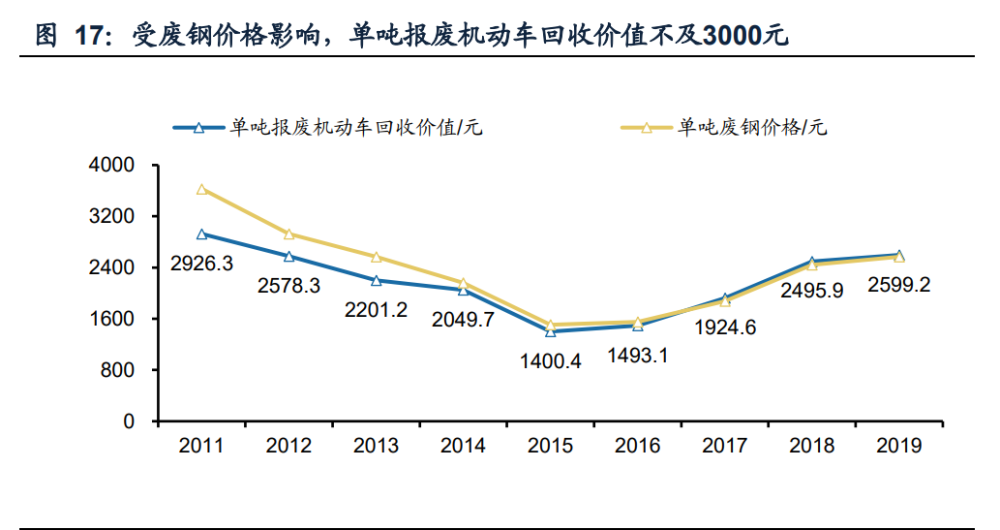

Before the lifting of the ban on "five major assemblies" remanufacturing, regular car recycling and dismantling enterprises had low profits and heavy tax burdens. Before the lifting of the ban on remanufacturing of the "five major assemblies", most of the scrapped cars could only be sold as scrap steel after being dismantled. In recent years, the price of scrap steel has continued to be sluggish and fluctuated widely, with the highest still being less than 3,700 yuan/ton, according to the Ministry of Commerce. It is estimated that the recycling value of a single ton of scrapped motor vehicles is less than 3,000 yuan; at the same time, the scrap steel sold by some recycling companies has a long settlement period, and the funds are occupied by the steel mills for a long time, which has a great impact on the profitability of recycling and dismantling companies. In addition, hazardous waste such as waste oil, waste batteries and industrial solid waste generated in the dismantling process of scrapped vehicles require complete equipment configuration for disposal, resulting in high fixed costs and disposal costs for enterprises. Over 90% of the scrapped vehicles come from private cars, compulsory scrapped vehicles or vehicles used by administrative institutions, and cannot obtain input deductible invoices, and the recycling enterprises need to pay the full value-added tax at 17%. High costs and low incomes are superimposed on heavy tax burdens, resulting in generally low profits and even loss of formal scrapped car recycling and dismantling enterprises. (Report source: Future Think Tank)

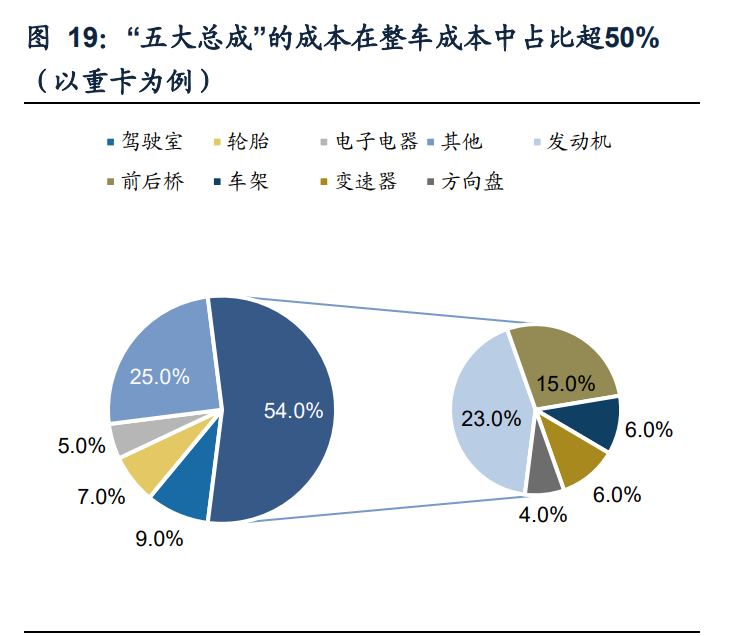

The remanufacturing ban of "five major assemblies" is lifted, and the automobile dismantling industry has ushered in a new growth point. The "five assemblies" of a car include the engine, steering wheel, gearbox, front and rear axles and frame. As the core components of automobiles, the cost of "five assemblies" accounts for more than 50% of the total vehicle cost, and is the five most valuable components for recycling. Reviewing the evolution of automobile dismantling policies, the policy for the "five major assemblies" has gradually evolved from the 2001 "Administrative Measures for Scrap Vehicle Recycling", which has gradually evolved into a pilot program for remanufacturing of the "five major assemblies" starting in 2008, expanding the pilot program to From 2019 to 2022, the remanufacturing of the "five major assemblies" will be released and technical specifications will be carried out. The remanufacturing of the "five major assemblies" will increase the recycling price of auto parts, thereby increasing the terminal collection price, effectively promoting the flow of scrapped cars back to regular car dismantling enterprises, and further improving the car recycling and dismantling rate.

The lifting of the ban on remanufacturing of the "five major assemblies" has promoted a substantial increase in the profit of dismantling traditional energy vehicles. Before the remanufacturing of the "five major assemblies" of scrapped cars is lifted, the price can only be calculated with reference to the market price of scrap metal. Taking the engine as an example, if an engine of about 250 kg is sold as scrap steel, it can only be sold for 300-600 yuan. After the remanufacturing of the "five major assemblies" is released, the scrapped engine can be professionally repaired or upgraded by a third-party certified remanufacturing company, and finally sold with a performance not lower than the prototype new product, and the recycling price is determined by the market players themselves. , the price can reach 2-3 thousand yuan. It is estimated that the opening of the "remanufacturing" authority will increase the recycling value of traditional car dismantling from less than 4,000 yuan to nearly 9,500 yuan. With the substantial increase in the recycling value, it will stimulate the corresponding recycling willingness, which is expected to drive the recovery rate growth.

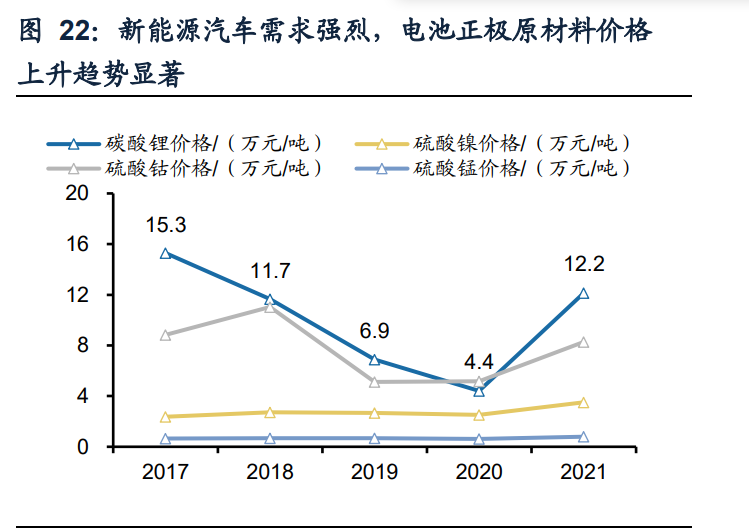

The demand for new energy vehicles is strong, the price of battery cathode raw materials is rising significantly, and there is a broad space for dismantling in the future. Since 2013, the large-scale promotion and application of new energy vehicles has entered the fast lane of development. In 2021, its sales volume will exceed 3 million, a year-on-year increase of over 150%, showing a sustained and rapid growth trend. On the demand side, the rapid growth of new energy vehicles has driven the growth in demand for battery materials, driving the prices of manganese salts, nickel salts, and cobalt salts, raw materials of battery precursors, to record highs; on the supply side, the difficulty of developing lithium resources and the constraints of development technology The supply of lithium resources, the disturbance of the epidemic and the chaos of international shipping have led to a decline in metal imports, and the shortage on the supply side has further supported the rise in the price of lithium carbonate, a raw material for battery cathodes, which will increase by more than 250% year-on-year in 2021.

Power battery recycling has huge profits, and the recycling value of new energy vehicles is much higher than that of traditional energy vehicles. Similar to the "five assemblies" of traditional energy sources, the "three electric" systems (battery, motor, and electronic control) of new energy vehicles are the core components of the car, and their cost accounts for about 50% of the total cost, of which the electric drive assembly (mainly including motor, electronic control, reducer), the cost of power battery accounts for about 10% and 40% of the total cost, respectively. Along with the rise in raw material prices, the prices of retired batteries have also risen. Taking the ternary lithium battery NAM811 as an example, the content of lithium, cobalt, nickel and manganese in the positive electrode material is about 7.13%, 6.06%, 48.27% and 5.65%, respectively. If all these metals are recycled, the recycling value of the power battery will be about 25,000 yuan, which will lead to a rise in the value of the scrapped and recycled unit of new energy vehicles to over 30,000 yuan, which is about 8.6 times the scrapped and recycled value of traditional energy vehicles.

The "five major assemblies" and the huge profits of power batteries will promote the market space of automobile dismantling to reach 127.13 billion yuan in 2025. The weight of the five major assemblies of traditional energy vehicles accounts for about 68.2%, of which the recovery value of the engine and gearbox is up to 5,000 yuan, which promotes the recycling value of traditional energy vehicles to 9,487.8 yuan. In the new energy vehicle, the weight of the "three electric" system accounts for about 22%, of which lithium, cobalt, nickel, and manganese in the power battery account for over 65% of the weight of the positive electrode, and the aluminum material in the battery shell accounts for 30% of the total battery weight. , the total value of power battery metal recovery exceeds 25,000, and the recycling value of new energy vehicles is increased to over 32,000. We estimate that in 2030, the recovery rate of automobiles will be 38%, corresponding to a total of 11.727 million dismantled automobiles, and the market space will be as high as 262.76 billion yuan.

(3) Growth in dismantling volume: strengthen the extended producer responsibility system, and improve the dismantling rate through life cycle management

Under the extended auto producer responsibility system, both the quantity and quality of auto recycling and dismantling are expected to increase. Following the promulgation of the Implementation Plan for the Extended Producer Responsibility System, the government will launch the Pilot Implementation Plan for the Extended Producer Responsibility for Automobile Products in 2021, which aims to encourage automobile manufacturers to use the after-sales service network to cooperate with dismantling and remanufacturing companies. Establish a reverse recycling system. Under the guidance of government funds, technical support and corresponding indicators, automobile manufacturers will promote the standardized handover of scrapped vehicles by car owners through incentive measures such as trade-in, points-for-purchase, maintenance discounts, etc., and drive the formal recovery rate to increase. The implementation of this will promote upstream and downstream collaboration in the industry chain and improve the comprehensive utilization of scrapped vehicle resources.

The supervision of automobile recycling and dismantling becomes stricter during and after the event, and guides the standardized development of the industry. Previously, due to regulatory omissions, price differences and other reasons, there were often cases of scrapped cars in the market "stealing the pillars to go to the countryside, making a facelift", and it was difficult to trace the source. In the past two years, the "Administrative Measures for the Recycling of Scrap Motor Vehicles", "Technical Specifications for Recycling and Dismantling Enterprises of Scrap Motor Vehicles", and "Interim Measures for the Management of Auto Parts Remanufacturing Specifications" Detailed and strict specifications and standards have been formulated for the entire process, from the establishment of a sales ledger, a full-coverage electronic monitoring system, and a full-life-cycle traceability system for remanufactured products. The rectification of the ecological chaos in the industry has increased the difficulty of survival in the black market of illegal recycling of automobiles, and the market share of formal recycling enterprises is expected to increase.

3. Overseas tour: extension of producer responsibility + subsidies + technology iteration

(1) Expand the extended producer responsibility system to form a large-scale effect in the industrial chain

The EU adopts the model of joint recycling of end-of-life vehicles and establishes a producer responsibility organization (PRO) to promote the large-scale development of vehicle dismantling. PRO is a responsible organization established by automobile manufacturers. It is an intermediate link between manufacturers and recycling companies. EU car manufacturers do not need to set up their own recycling companies. They only need to join PRO in the form of special license. The recycling and demolition contracts signed by PRO Understand the enterprise to complete the corresponding work. If the Netherlands establishes the Automobile Recycling Association (ARN) to perform the extended producer responsibility obligation on behalf of the Dutch car producers, the car manufacturer needs to pay a car scrap tax of 250 Dutch guilders to the ARN for each car produced. A high fine of 10,000 euros per day; and ARN has signed contracts with about 350 scrapped car recycling and dismantling companies. These companies adopt refined dismantling technology in the process of car dismantling, and the proportion of reused parts is relatively high. It improves the recycling value of scrapped cars, guarantees the profit source of recycling and dismantling companies, and promotes up to 87% of scrapped scrapped cars written off in the Netherlands to flow into ARN for recycling.

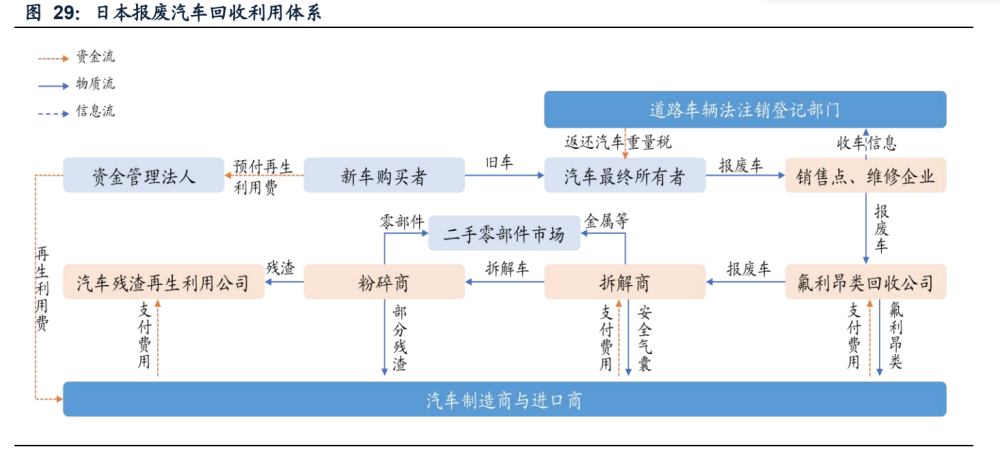

Japan adopts a compulsory recycling model to ensure the recycling of car dismantling materials. In 2000, the Japan Automobile Industry Association and other nine organizations initiated the establishment of the Japan Scrap Automobile Recycling Promotion Center to implement the scrap automobile recycling and disposal system of the extended producer responsibility system. The "Automobile Recycling Law", which came into effect in 2005, expands the responsibility of automobile manufacturers to recycle used vehicles, and stipulates that manufacturers must undertake the recycling and disposal of designated parts such as automobile residues and airbags. The national automobile recycling and dismantling rate exceeds 65%. %.

(2) Increase subsidies, expand sources of subsidies, and promote standardized development of the industry

There are many cases in foreign countries that guide the development of the industry through high and multi-channel subsidies. The subsidy level for end-of-life vehicles in the United States can be as high as $4,000 per vehicle (about 25,500 yuan per vehicle) (comparison: the price of a Toyota Corolla in the United States starts at $18,500); the EU adopts a producer-pays system to promote car dismantling, and car manufacturers need to Pay a recycling fee of about 200 US dollars (about 1275 yuan / vehicle) for each scrapped car; Japan has established a complete recycling and disposal fund, and consumers have to pay a car recycling fee when purchasing a new car (about 10% of the total car model). 0.5%-1.0%), which is used to subsidize the recycling of used cars, and there is also a corresponding preferential tax system for actively scrapped cars, which can reduce or exempt up to half of the car tax and 300,000 yen (about 16,000 yuan) car acquisition tax.

The subsidies for scrapped vehicles in my country are small and the source is single. Although the scope of my country's automobile scrapping subsidies has been extended from trucks and passenger cars to private cars and special operation vehicles, and the amount of subsidies has increased, there is still a certain gap between the subsidy strength and the informal recycling price. One car in the first-tier cities is illegal in the second-hand car market. The recycling price is as high as 30,000-40,000 yuan, while the maximum amount of the scrapped car subsidy is 18,000 yuan, and it is limited to heavy-duty trucks, city buses and certain cars. In addition, financial subsidies, as the only source of subsidies for scrapped vehicles in my country, are not sustainable.

Referring to the extended producer responsibility system of the e-waste dismantling fund, the automobile dismantling policy may introduce fund subsidies to drive the development of the industry. The recycling of electronic waste is similar to car dismantling. If it is difficult to cover the dismantling cost only by the selling price of the dismantled products, another subsidy fund is needed to pay. In order to guide the development of the waste electricity dismantling industry, my country collected waste electricity dismantling funds from production enterprises in 2012 to subsidize the recycling enterprises, ensuring that the dismantling enterprises will form a reasonable profit after superimposing the subsidies. If auto dismantling introduces fund subsidies in the future, the enthusiasm of dismantling enterprises will be greatly improved, which will drive the accelerated development of the industry.

(3) Improve refined dismantling technology, improve resource utilization and ensure profitability

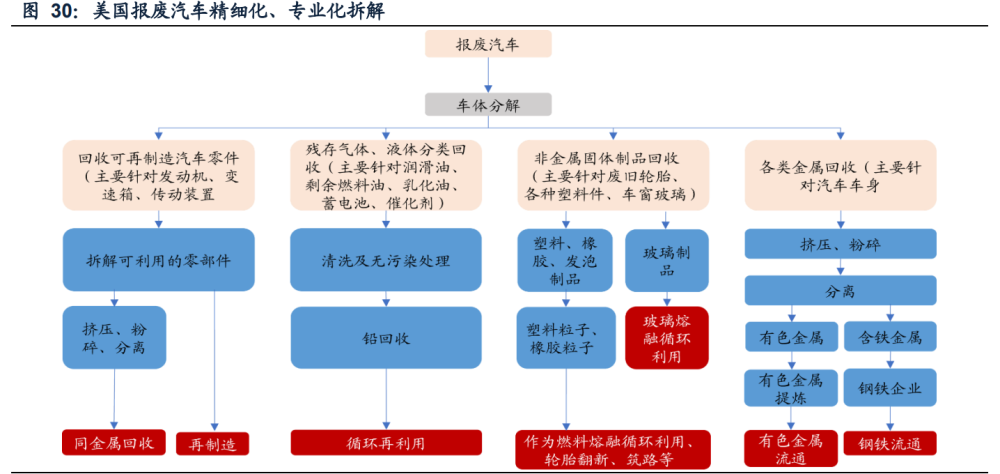

The United States established the Vehicle Recycling Alliance (VRP) to ensure the ease of disassembly and recyclability of auto parts. The three major American automobile companies, GM, Ford, and DaimlerChrysler, established the Vehicle Recycling Alliance (VRP) in 1991 to standardize the recycling process of end-of-life vehicles, jointly fund research on the recycling technology of end-of-life vehicles, and dismantle them through refined and specialized dismantling. Increase the recycling rate of parts to 95%. According to China Automobile News, there are currently more than 12,000 auto dismantling companies in the United States, more than 200 professional crushing companies, and more than 50,000 parts and components remanufacturing companies. Within one year, 16 million tons of scrap steel and 850,000 tons of scrap aluminum can be recycled. , 240,000 tons of scrap copper, 112,000 tons of scrap zinc, 386,000 tons of scrap tires, and more than 46,000 tons of remanufactured parts. The total scale of the scrap car processing industry is 70 billion yuan, accounting for one-third of the overall output value of the US circular economy. one.

Domestic automobile dismantling has a low level of automation and serious environmental pollution. my country's automobile dismantling is still mainly manual, lacking comprehensive and mechanized dismantling equipment, and the dismantling technology is backward. At present, many car dismantling enterprises in my country still focus on destructive and extensive dismantling. After dismantling, what can be recycled is basically limited to scrap iron and steel and large and easy-to-separate non-ferrous metals, other materials (such as plastics, Most of them are discarded because they cannot be recycled effectively. In addition, more than ten types of hazardous wastes, such as waste oil, waste lead-acid batteries, waste catalysts, and waste refrigerants, will be generated in car dismantling. Many illegal car dismantling enterprises in China often operate in the open air without any pollution prevention and control facilities. Disposal is not standardized, causing serious environmental pollution. According to the statistics of the central ecological and environmental protection supervision, the chemical oxygen demand concentration of water around some scrapped car dismantling enterprises is as high as 443 mg/L, and the concentration of petroleum is 962 mg/L, which respectively exceed the "Surface Water Environmental Quality Standard" Class III standard. 21.2 times and 19,239 times, with high risks and high pollution.

With the upgrading of intelligent systems and the large-scale recycling enterprises, the pipeline dismantling method is expected to improve the above problems. At present, the automobile dismantling process is mainly divided into two types: the fixed station dismantling method and the assembly line dismantling method. Due to the simple process, low equipment cost and subsequent maintenance cost, the fixed-station dismantling method has become the most mainstream dismantling process in my country. However, this method adopts the method of "people walking but not vehicles", with a low level of automation, mainly relying on manual dismantling, complicated streamlines and low efficiency, and is only suitable for small-scale dismantling. At present, large-scale dismantling plants adopt an assembly-line dismantling method. According to different vehicle transportation methods, the assembly line can be divided into ground-based dismantling lines, suspended dismantling lines and ground-air mixed dismantling lines. The assembly-line dismantling method adopts the mode of "cars leave and people do not leave", which greatly improves the dismantling efficiency.

4. Analysis of key companies

(1) Wangneng Environment: Relying on Meizuda's auto dismantling channel, it is expected to enter the new field of recycling

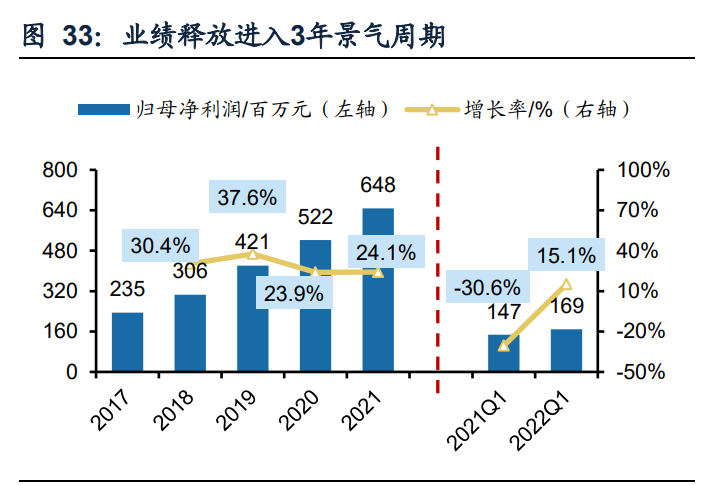

The production capacity of solid waste projects continued to climb, and the high profits of the main business provided a guarantee for the recycling business. Since 2018, the company's operating income has maintained rapid and positive growth, and its gross profit margin has been at the mid-to-upstream level in the industry; its performance has continued to improve in recent years, entering a 3-year boom cycle and maintaining an upward trend. In recent years, the company's stock projects have brought high growth in revenue and performance. New projects have been put into operation at an accelerated pace, and production capacity has accelerated. It is expected that the operating production capacity in 2023 is expected to reach 28,000 tons per day. High profits superimposed on the main business and high production capacity strengthen the company's business operations and provide guarantees for the company's expansion of new businesses.

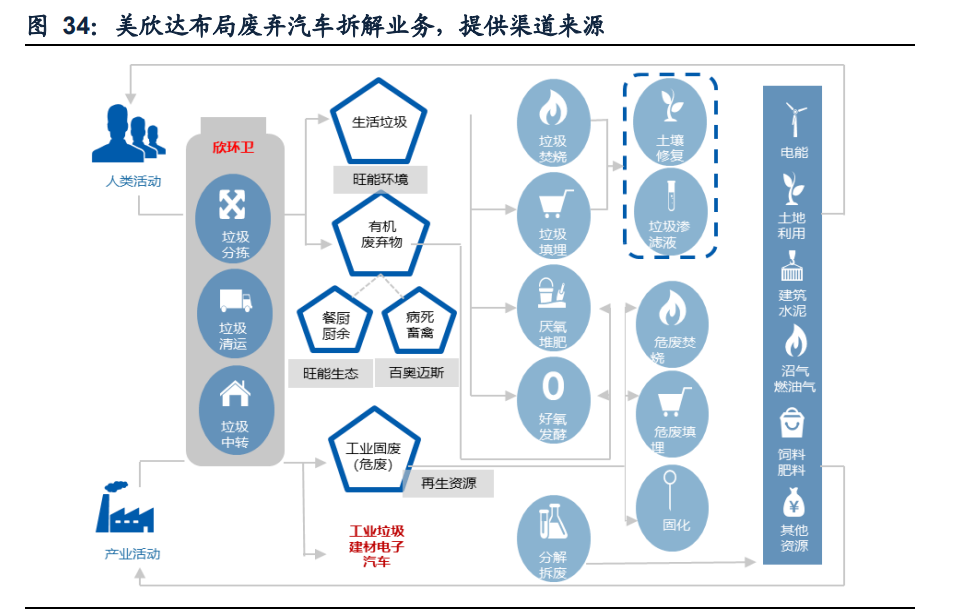

Entering new fields by acquiring lithium battery recycling target companies, the recycling project was officially launched in April 2022. The company obtained 60% equity of Lixin New Materials through acquisition and subscription. The target company is mainly engaged in the recycling of lithium battery waste. Its power battery extraction cobalt nickel lithium project (Phase I) will be officially operated in April 2022, and the load rate has climbed to production. To 80%, it is expected to complete more than 70% of the production capacity in the whole year and reach production in 2023; the project corresponds to the purification capacity of nickel, cobalt and manganese of 3,000 gold tons/year (expanded to 7,500 gold tons/year in 2022H2), and the purification capacity of lithium carbonate is 1,000 tons/year (Expanded to 2,800 tons/year in 2022H2), with a total production capacity of over 10,000 tons/year of lithium, cobalt, nickel and manganese resource products, laying the foundation for the company to carry out battery recycling business. The company also plans to recycle 60,000 tons of waste batteries per year of lithium iron phosphate batteries. The company's shareholder, Meizuda Group, has a dismantling capacity of 100,000 vehicles per year, which is expected to form a good synergy with the company's lithium battery recycling.

Shareholder Meizuda has deployed the automobile dismantling industry and continuously extended the industrial chain. In addition to the garbage disposal business, the company's shareholder Meizuda Group has a mature layout in the dismantling and recycling industry of scrapped vehicles. According to Huzhou Daily, Meizuda Recycling Industrial Park currently recycles 100,000 scrapped motor vehicles annually, with a crushing capacity of 200,000 tons. The recycling volume of its motor vehicle recycling and dismantling company ranks among the top three in the industry in 2020, providing a stable source of waste for the lithium battery recycling business. In 2021, the Group will complete a demonstration project of intelligent dismantling, recycling and comprehensive utilization of waste vehicles with an annual output of 100,000 vehicles. The project adopts an automated green dismantling production line, which can effectively separate more than 50 kinds of metals after dismantling scrapped vehicles, so as to achieve deep resource utilization. .

In addition, Meizuda takes the recycling and dismantling business of scrapped motor vehicles as the carrier, and continues to expand and extend the industrial chain in the fields of subdivision picking, deep processing, reuse and remanufacturing of waste resources. At present, the Group's crushing center with an annual processing capacity of 200,000 tons and a waste tire and rubber recycling project with an annual output of 60,000 tons of recycled rubber and 25,000 tons of fine rubber powder are already in operation. Backed by shareholder Meizuda's many years of experience in auto dismantling industry technology and channels, the company has the advantage of exploring the field of auto recycling.

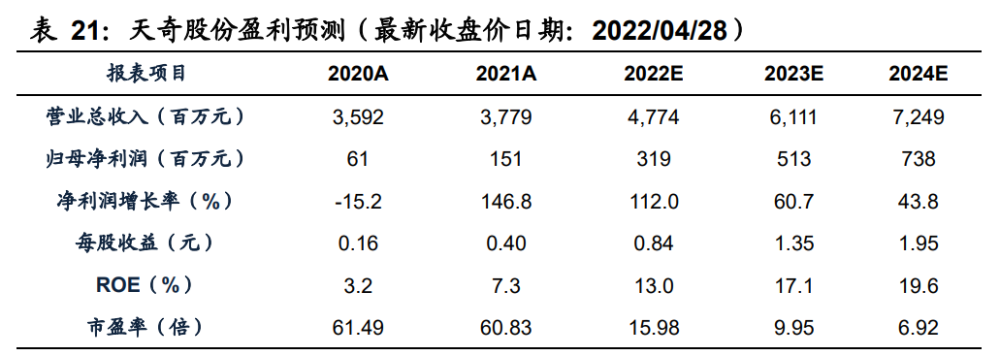

(2) Tianqi Co., Ltd.: the deep layout of the automobile industry chain, the pioneer of recycling, dismantling and recycling

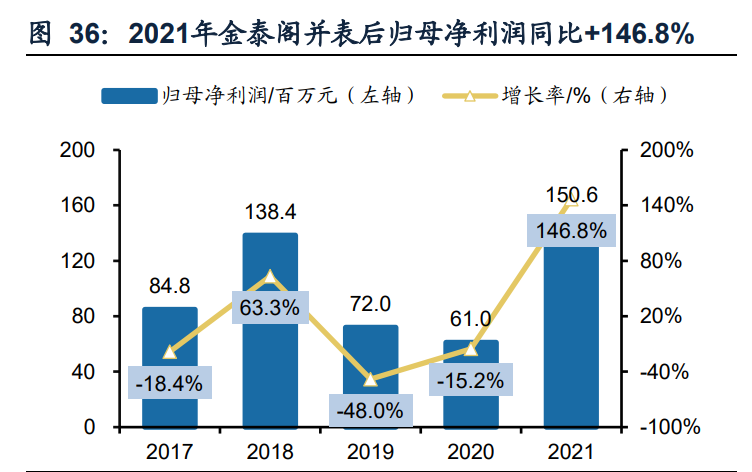

New lithium battery recycling business, expansion of production and layout of recycling channels are in progress. In the past five years, the company's revenue has increased from 2.46 billion to 3.78 billion. In 2021, the power battery subsidiary Jintaige will be consolidated, driving the company to achieve a net profit of 15.06 billion yuan (+146.8% year-on-year). The company's layout around the entire life cycle of automobiles drives the company to transform into a lithium battery recycling business. The company's ternary battery recycling capacity will reach 20,000 tons/year in 2021, and will expand to 50,000 tons/year in the second quarter of 2022. In March 2023, it will add 50,000 tons/year of lithium iron phosphate recycling. Completed 150,000 tons/year lithium iron phosphate recycling capacity. The company's power battery recycling capacity has grown rapidly, and the mapping performance has been released rapidly.

At the same time, the company also plans the precursor manufacturing business, and finally forms a complete industrial chain of waste battery resource utilization of "battery recycling-element extraction-material manufacturing". In addition, the company has strategically cooperated with JD.com, FAW, and Xingheng, etc., and plans to build in-depth cooperation in the fields of power battery recycling and remanufacturing of core auto parts, and use the "Internet +" recycling system to create operation channels and build a stable supply of goods. The company's production capacity has a first-mover advantage. Through the framework agreement, it further expands the recycling channels of power lithium batteries, stabilizes the supply of raw materials, and continues to strengthen its channel capabilities. In the future, with the increase in the waste of power batteries, it is expected to further increase the volume of revenue and profit.

Continue to build the integration of the industrial chain before and after the automobile, and develop the field of automobile dismantling and recycling in depth. The company has entered the field of automotive automation equipment since 1984, and has continued to expand around the automotive industry chain. On the one hand, based on the equipment side, it develops businesses such as automotive intelligent equipment and scrapped car dismantling equipment, deepening cooperation with automotive companies, and on the other hand, entering the operation side. Landed car dismantling. In 2021, the subsidiary Hubei Lidi Machine Tool will complete the development of 9 new products including the RGV cycle trolley scrapped car dismantling line, and complete the transformation and upgrading of the crushing and processing equipment to continuously optimize the performance of the car dismantling line.

Subsidiary Ningbo Recycling, as an enterprise with the qualification for recycling and dismantling scrapped vehicles in Ningbo, has 8 branches, and will add new energy vehicle dismantling equipment through technological transformation to develop in coordination with the company's lithium battery recycling industry. The company has been deeply involved in the automobile industry for more than 30 years. At present, the company's recycling sector has formed a complete industrial chain layout of automobile dismantling equipment manufacturing, waste automobile recycling and dismantling, fine sorting of dismantled materials, remanufacturing of core components and power battery recycling and reuse. Subsidiaries exert synergistic effects to realize high-value utilization of recycled resources in the automotive aftermarket, with outstanding comprehensive advantages.

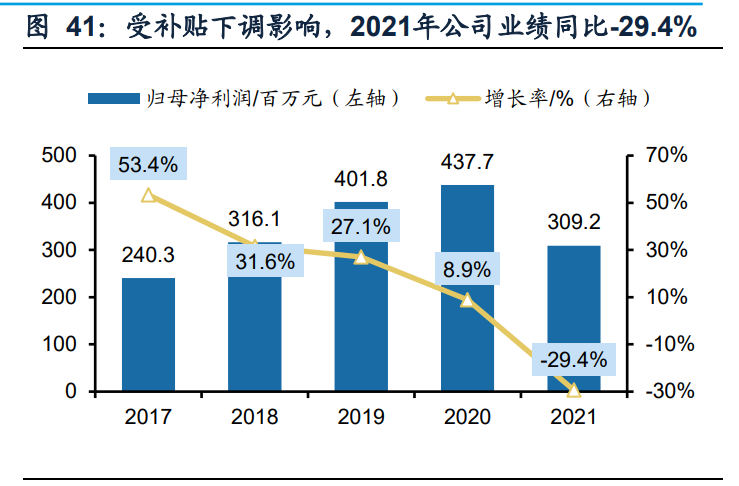

(3) China Re-investment Environment: The "national prefix" electric waste leader, the group's assets are rich in volume

The leader in the waste electricity dismantling industry, and the expansion of production capacity accelerates the increase of market share. The company's revenue in 2021 is 3.469 billion yuan (-1.3% year-on-year), and the net profit attributable to the parent is 309 million yuan (-29.4% year-on-year). The decline in revenue performance is mainly due to the reduction of subsidies in 2021. The dismantling volume continued to grow, and the number of dismantling units exceeded 20 million for the first time during the year. As a leader in waste electricity dismantling, the company has expanded its production capacity to 37.88 million units per year at a fixed rate. It has added a variety of dismantling lines such as non-motor vehicle dismantling lines and small waste household appliances dismantling lines. The continuous strengthening of technical barriers has driven profits to increase to To enter the field of automobile recycling to provide protection.

Relying on the advantages of the Group's scarce recycling channels, there is a broad space for the integration of automobile recycling and dismantling business. The company's actual controller, Supply and Marketing Group, has a wide range of renewable resource recycling categories, and the 2020 renewable resource business revenue is 30.3 billion yuan. In 2022, the first and second largest shareholders of the company will be merged, and the controlling shareholder Zhongsheng Regeneration has initially established 7 regional recycling networks in 23 provinces (autonomous regions and municipalities) across the country, including Bohai Rim, Northeast China, East China, Central South China, South China, Southwest China and Northwest China. There are 1 scrap car dismantling plants, 15 scrap car dismantling lines, and more than 5,000 recycling outlets, covering Zhejiang, Shandong, Heilongjiang, Jiangxi, Henan, and Ningxia, forming a scrap car dismantling network covering most of the provincial capital cities across the country.

In addition, China Recycling actively expands the whole industrial chain of scrap car dismantling. At present, China Recycling has more than 18 scrap steel production, processing and shredding lines. A total of 20 subsidiaries of its subsidiaries have passed the "Ministry of Industry and Information Technology Scrap Steel Processing Access Conditions" enterprises, and can enjoy 30 % value-added tax preferential policies, the declared production capacity is more than 6.5 million tons, and its automobile dismantling business is in a leading position in China with its unique recycling channel advantages and efficient resource utilization. With the rationalization of the company's shareholding structure, the Group's automobile recycling and dismantling business may be integrated, with broad development space. (Report source: Future Think Tank)

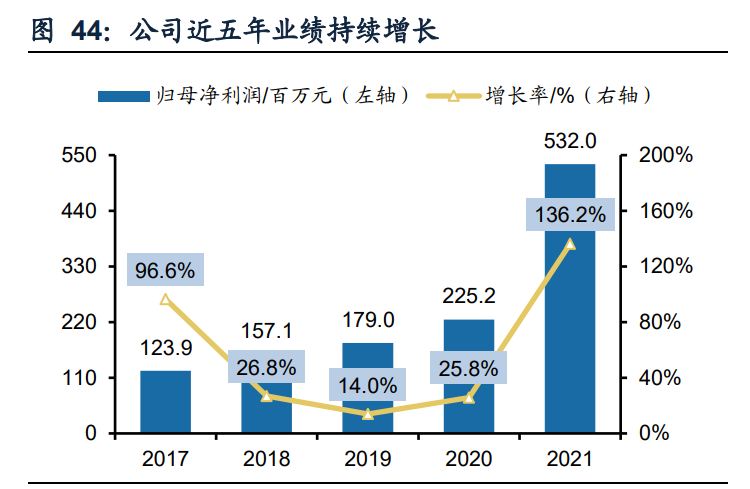

(4) Huahong Technology: Deeply cultivating renewable resource equipment manufacturing, pioneer in automobile recycling and dismantling

Based on the manufacturing of renewable resources processing equipment, the advantages of automobile recycling channels are significant. The company's performance in the past five years has continued to grow. In 2021, the net profit attributable to the parent is 530 million yuan, a year-on-year increase of 136.2%. As a leading scrap steel processing equipment enterprise in China, the company actively expands downstream renewable resource operation business by relying on its equipment advantages, and has now formed a circular economy technology industry focusing on scrap steel processing and trade, comprehensive recycling and utilization of scrapped automobiles, and comprehensive utilization of rare earth recycled materials.

Deploy three major automobile dismantling and scrap steel processing bases, and build an all-round automobile recycling and dismantling resource utilization industry chain. In 2018, the company entered the field of automobile recycling and dismantling operations through the acquisition of Beijing Zhongwubo (now Beijing Huahong), and used this as the main line to expand downstream scrap steel processing trade business and comprehensive recycling of other metal and non-metal resources. The company currently has three major scrap steel and automobile dismantling bases in Jiangsu Donghai, Beijing, and Hebei Qian'an. Beijing Huahong, as the largest automobile dismantling base, has the qualification for scrapping retired military equipment; Donghai Huahong and Qian'an Juli are the Two major scrap steel recycling and processing bases, with an annual scrap steel processing capacity of 800,000 tons. In 2020, the company's scrap steel processing and scrapped vehicle utilization business achieved revenue of 620 million, accounting for 18.5% of total revenue. At present, the company has built a complete industrial chain from the production of scrapped motor vehicle dismantling equipment, automobile recycling to back-end resource utilization, and the synergy effect is prominent.

QQ客服

QQ客服